Bitcoin Gaps Higher - Fed & Trump On Watch

BTC Rallying

Bitcoin prices are looking more encouraging for bulls this week with the futures market gapping higher at the weekly open, and now up around its highest levels in two weeks. The market had been caught in a block of consolidation around the $108,855 level in recent weeks following the heavy selling we saw on the back of Trump’s tariff threat against China at the start of the month.

US/China Optimism

Constructive talks on between US and Chinese officials over the weekend and the prospect of Trump and Xi agreeing a trade deal when they meet this week is having a strong upwards impact on risk assets this morning. Bitcoin has moved higher amidst this broader risk-on push and looks poised to gain furtehr ground this week if optimism remains high into Thursday’s meeting between the two leaders. Should a deal be agreed, Bitcoin could quickly move back up to YTD highs with risks of a fresh breakout seen.

FOMC On Wednesday

Ahead of Thursday’s meeting between Trump and Xi, traders will be watching the Fe don Wednesday as it meets for the October FOMC. A fresh .25% cut is widely expected (and priced in) at this point. As such, the focus will be on the bank’s guidance and the prospect of furtehr easing ahead of year end. Given the absence of labour market data since the last meeting due to the US govt shutdown, the Fed is expected to note more uncertainty in the outlook than usual, though comments are expected to lean to the dovish side, keeping easing forecasts intact. This should add furtehr fuel to the risk-on rally this week, leading BTC higher again.

Technical Views

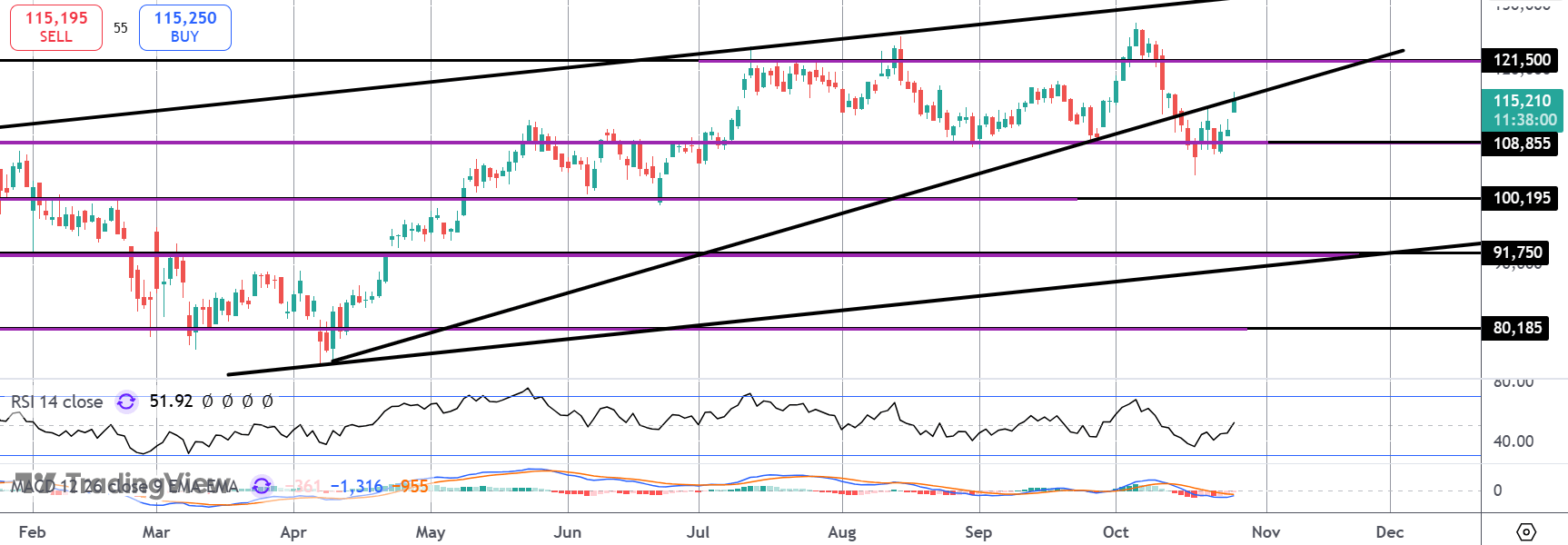

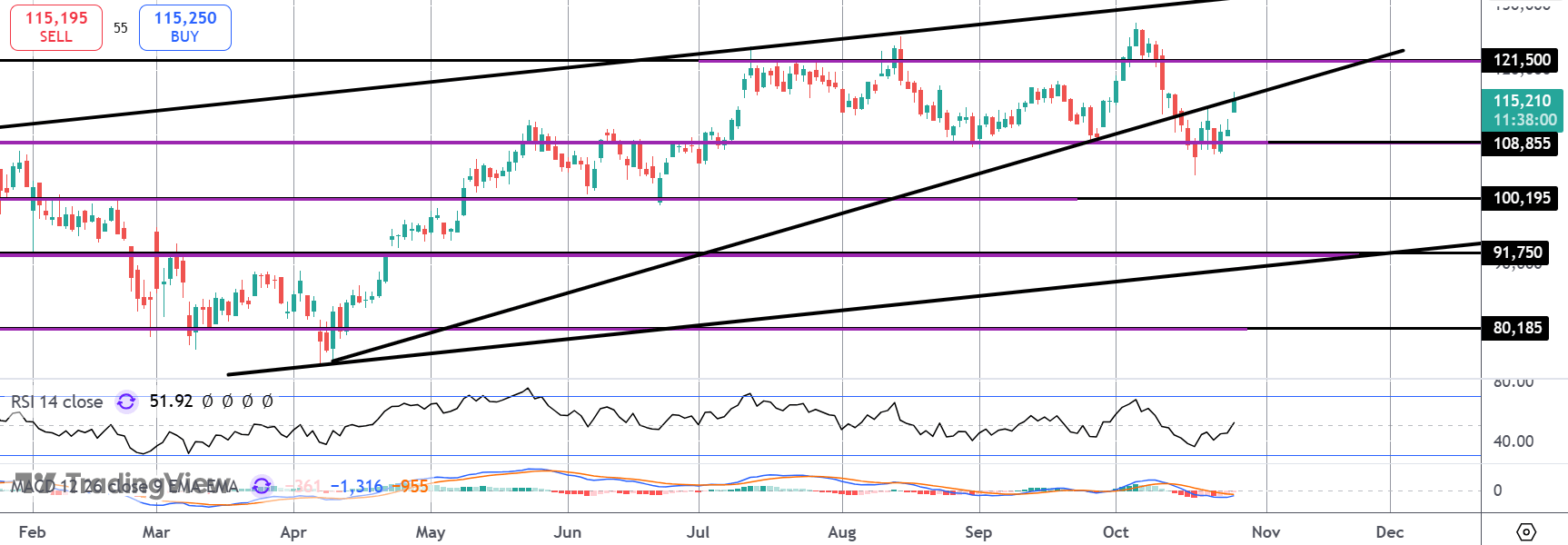

BTC

The rally off the $108,855 level is seeing price retesting the broken bull trend line from YTD lows. If bulls can get back above here, $121,500 will be the next resistance to note with YTD highs the main objective above that. $108,855 remains key support for bulls to defend.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.