NFP Up Next

The US Dollar remains weak on Tuesday as traders brace for the delayed November NFP data which will be delivered today, alongside the November ADP figure and ISM manufacturing and services data. As such, there is high volatility risk today with US rate expectations for Q1 likely to be heavily influenced by these jobs readings. On the numbers front, the November NFP is expected to lift to fall to 51k from 119k prior while wages are expected to lift slightly to 0.3% from 0.2% prior and the unemployment rate also lift to 4.5% from 4.4%. If these forecasts are met, USD is likely to remain weak as Q1 rate-cut pricing creeps higher through year end.

Bearish View

A fresh drop in the NFP will keep labour market concerns in the spotlight. If we see a downside surprise today, this should see USD selling intensify as Jan rate cut pricing lifts firmly (currently around 25%). The Fed noted at the December FOMC that any future cuts will be heavily data dependent. As such, a downside surprise today (lower NFP, higher unemployment) could be the catalyst for a fresh downturn in USD through year end, with plenty of room for Jan rate-cut pricing to increase.

Bullish View

On the other hand, if data surprises to the upside today, this should effectively rule out a January cut with USD likely to rally accordingly. The Fed sounded less convinced about the need for further easing near-term than USD bears were hoping. Citing its intention to remain data dependent Powell signalled that the Fed could hold rates steady near-term. As such, only weak data is likely to drive USD lower for now.

Technical Views

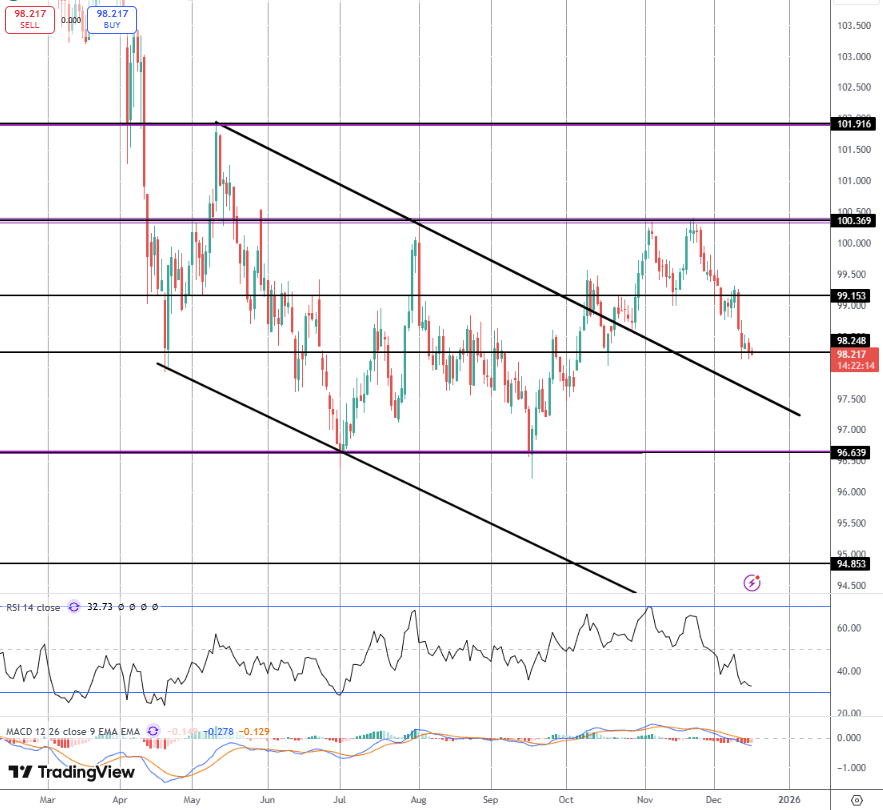

DXY

The sell off in DXY has seen price falling back down to test the 98.24 level with the retest of the broken bear channel highs sitting just below. With momentum studies bearish, focus is on a continuation lower with 96.63 the deeper level to target. The bear view only weakens if price recovers above 99.15 near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.